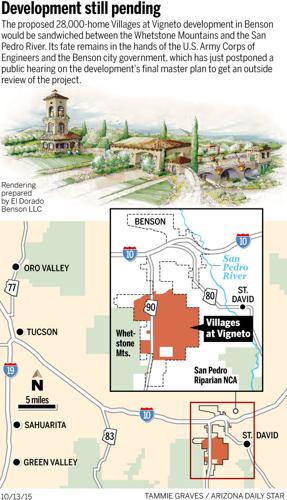

The proposed 28,000-home Villages at Vigneto development will transform depressed economies of Benson and Cochise County, ŌĆ£spurring unprecedented economic activity, business development and population growth,ŌĆØ says a new analysis done for the projectŌĆÖs developer.

The Benson development, while controversial due to its potential environmental impacts, is projected to generate $23.8 billion in various kinds of economic activity over a planned 18-year construction period ending in 2032, says the report. It was written by Robert Carreira, a longtime Cochise College economist now working as a private consultant.

CarreiraŌĆÖs report is based on economic assumptions provided by the developer, including some that would buck recent trends in the area.

By 2020, the project is expected to generate $1.2 billion in annual economic impacts and to support nearly 9,460 construction and other jobs, the report says. Besides housing, the development also is supposed to have 4.4 million square feet worth of office, retail, industrial, golf, a resort and other forms of nonresidential development. The development, planned by Phoenix-based El Dorado Holdings LLC, would be marketed nationally and internationally and cater heavily, but not exclusively, to retirees.

People are also reading…

In 2031, a year before construction is slated to finish, the projectŌĆÖs annual economic fallout should peak at $2 billion and generate more than 16,000 total jobs, the report says.

Beyond that, Vigneto’s tax revenues paid to Benson city coffers of $557 million over 18 years will exceed by 17 percent the costs the city will pay to provide police, fire, library and other public services to the project, says Carreira, president and chief economist of and the soon-to-be retired director of Cochise College’s Center for Economic Research.

The projectŌĆÖs development plan has won preliminary approval from Benson officials, with final approval pending. The Army Corps of Engineers is being asked by environmentalists to reconsider or revoke a federal Clean Water Act permit it gave an earlier version of this project back in 2006. If all goes smoothly for the developer, construction could start next year. But environmentalists are likely to sue to stop the project if the Corps continues to OK it, out of concern that the groundwater pumping for the ├█┴─ų▒▓ź could dry up the San Pedro River.

Untested assumptions

CarreiraŌĆÖs prediction that the project's benefits will outweigh costs rests on the still-untested assumption that a planned Benson Community Facilities District will raise enough revenue from the developmentŌĆÖs homeowners and other landowners to cover all the costs of providing roads, water lines, parks and other infrastructure to the 12,000-acre project. Based on the developerŌĆÖs assumptions provided to the researcher, those costs would total $1.4 billion, at $50,000 worth of infrastructure per home.

The reportŌĆÖs overall predictions of economic transformation from the project also rest on several other positive assumptions. One is that it can sell almost as many new ├█┴─ų▒▓ź per year over a decade than were granted permits in Tucson at the peak of the last decadeŌĆÖs real estate boom. Another is that the projectŌĆÖs homebuilders will sell new ├█┴─ų▒▓ź for an average of $250,000, more than twice BensonŌĆÖs median home price, and that a typical Vigneto family will earn $65,000 annually, well over Cochise CountyŌĆÖs $45,700 median 2014 household income.

Those assumptions have been criticized as too rosy by Tricia Gerrodette, an environmentalist who opposes the project, and Norman Patten, a retired Realtor, both of Sierra Vista. But Carreira said they could indeed be realistic, based on the success of similar projects elsewhere, including one El Dorado developed in the town of Maricopa in Pinal County.

Alberta Charney, a University of ├█┴─ų▒▓ź economist, said a retirement community can be considered to be part of a larger communityŌĆÖs economic base, as Vig-

neto is envisioned. But that can bring a lot of negatives 20 years down the road, she said, when younger retirees age, become ill, use up their retirement income cushion and become dependent on the state.

ŌĆ£IŌĆÖm not a big fan of trying to get retirees to ├█┴─ų▒▓ź,ŌĆØ said Charney, who hasnŌĆÖt reviewed CarreiraŌĆÖs new report.

Carreira, however, said the Vigneto project is more likely to attract more-affluent buyers than the typical retirees.

ŌĆ£I would imagine the wealth effect there would more than offsetŌĆØ any economic problems suffered by the projectŌĆÖs retirees as they age, he said.

Indirect benefits shown by modeling

Starting with the number of ├█┴─ų▒▓ź and construction jobs expected, Carreira predicted the developmentŌĆÖs direct economic impacts, such as money paid for construction material and to construction workers. He used a computer model to forecast secondary and other indirect impacts, such as purchases by homebuilders and other related businesses of construction materials, office supplies and other services. He also looked at the projectŌĆÖs impacts on current area householdsŌĆÖ spending, along with new household spending by residents moving from outside the region.

The computer model was created by the U.S. Department of Commerce.

Construction activity will generate more than $14.4 billion in total spending in the project area from 2014 through 2032, the report said. Total annual spending by VignetoŌĆÖs new residents will grow from $210 million in 2020 to more than $1 billion by 2030, the report said.

By contrast, Cochise CountyŌĆÖs economy has been stuck in recession since 2011. CochiseŌĆÖs gross domestic product in the county dropped by a range of 0.7 to 3.9 percent annually in that time, the report said. The county has lost jobs every year since 2009, with 4,100 total job losses.

New home construction in Cochise County rose 10.5 percent in 2014, after eight years of decline. But permits were issued for only 179 single-family ├█┴─ų▒▓ź countywide in 2014, down more than 85 percent from 2005.

Home sales, prices presume rebound

Patten, a recently retired Sierra Vista Realtor, is dubious Vigneto would succeed in that atmosphere. He noted that the much larger cities of Sierra Vista and Tucson issued permits to 577 and 2,360 new single-family ├█┴─ų▒▓ź in the boom year of 2005.

ŌĆ£IŌĆÖm hard-pressed to figure out where theyŌĆÖre coming up with 28,000 ├█┴─ų▒▓ź over a 20-year period,ŌĆØ said Patten, who retired in January after 20 years as a Realtor, most recently in commercial real estate.

Carreira said that if you look at the regionŌĆÖs historic new-construction rates, ŌĆ£They would tell you thereŌĆÖs no way they could sell 2,000 ├█┴─ų▒▓ź a year in Benson or in Cochise County.ŌĆØ

But on the developerŌĆÖs side, he said, is that projects of this kind have succeeded when marketed internationally.

One of the projectŌĆÖs models is the Villages, a large retirement-oriented project near Ocala in central Florida. Since VignetoŌĆÖs developers predict half the number of home sales as what occurred there, ŌĆ£That tells me it can be done here,ŌĆØ Carreira said.

Plus, El Dorado has a successful record in Maricopa, where its project helped prompt population growth from 1,000 in 2000 to 47,000 last year, Carreira said.

ŌĆ£It raises the probability of their success much more than normally I could give it,ŌĆØ Carreira said of the Vigneto development. ŌĆ£In reality, thereŌĆÖs no way to evaluate how successful they will be until they start building and selling ├█┴─ų▒▓ź.ŌĆØ

The developer has set the $250,000 average home price based on average prices for ├█┴─ų▒▓ź in FloridaŌĆÖs Villages development, he said.

VignetoŌĆÖs $65,000 expected average homeowner family income is also based on that of the VillagesŌĆÖ target market, Carreira said.

David DiPeso, a Benson real estate broker and appraiser, said that if Vigneto does its international marketing and the local economy improves, ŌĆ£IŌĆÖm sure they can sell quite a few houses,ŌĆØ although 2,000 a year may be a little optimistic.

While the $250,000 home sale price far exceeds the current median home price of $123,000, that median price doesnŌĆÖt include many new ├█┴─ų▒▓ź right now because not many have been built lately.

ŌĆ£Once we get the foreclosures out of the market, weŌĆÖll be a lot better off,ŌĆØ he said. ŌĆ£When other projects were started back in the 2000s in the same area, they were selling for $300,000, $325,000 and $280,000. It will take a few years, but itŌĆÖs possible theyŌĆÖll come back to those prices again.ŌĆØ